“Since 2005, when the ITC was first passed by the Republican-led Congress and signed into law by President George W. Bush, the ITC has created hundreds of thousands of jobs, sparked more than $140 billion in private investment, and helped grow solar deployment by more than 10,000%.”

-Abigail Ross Hopper, President & CEO of the Solar Energy Industries Association.

Despite the ITC’s massive success, the step-down is still slated to take effect at the end of 2019.

Will the solar tax credit step-down affect commercial projects, too?

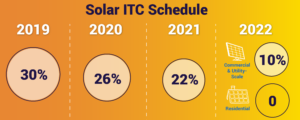

Yes! The federal credit for residential and commercial solar projects steps down to 26% next year, and to 22% in 2021. In 2022, the government will entirely eliminate residential credit. At that time, the commercial solar tax incentive will drop to 10%, where it will stay for the foreseeable future.

Is there hope for a solar tax credit extension?

In July, the House & Senate introduced The Renewable Energy Extension Act, a set of bills advocating for a five-year 30% extension of the Solar ITC. And just last month, a bipartisan group of 231 mayors sent a letter to Congress urging them to pass that Renewable Energy Extension Act. But an extension certainly isn’t guaranteed.

What you can do:

- Individuals: Contact your elected officials ASAP and urge them to extend the 30% federal tax credit. By joining the SEIA’s coalition to extend the federal tax credit, you can easily send a message to your representatives and stay abreast of news related to the extension bills. In Hopper’s words, “These bills are clear, easy wins … that create jobs, bolster the economy and address climate change. Polling shows that Americans across the political spectrum are concerned about our changing climate and they strongly support solar.” Click here to easily send your message.

- Businesses: Start installing a system in 2019. Commercial solar projects that begin construction before the end of 2019 can still qualify for the full 30% deduction if the business owner pays 5% of the total system cost in 2019.

Shifting the country’s energy usage to more sustainable sources will take time. In 2018, solar still only accounted for 1.5% of the United States’ electricity generation. The federal step-down reduces the fossil fuel industry’s competition in the national energy market. In turn, it stunts the job growth, innovation, and environmental benefits that the clean energy industry provides.

We hope you’ll join us in supporting the SEIA and the Renewable Energy Extension Act. And just in case those bills don’t pass, please contact us to start your commercial solar project before the end of 2019! We want to make sure your business receives the maximum possible financial benefits of going solar.